Retirement Account Contribution Limits 2024 Olympics

Retirement Account Contribution Limits 2024 Olympics. By fisher investments 401 (k) the irs determines how much individuals can contribute to various. These are the 2024 retirement account contribution limits for 401 (k) plans and iras.

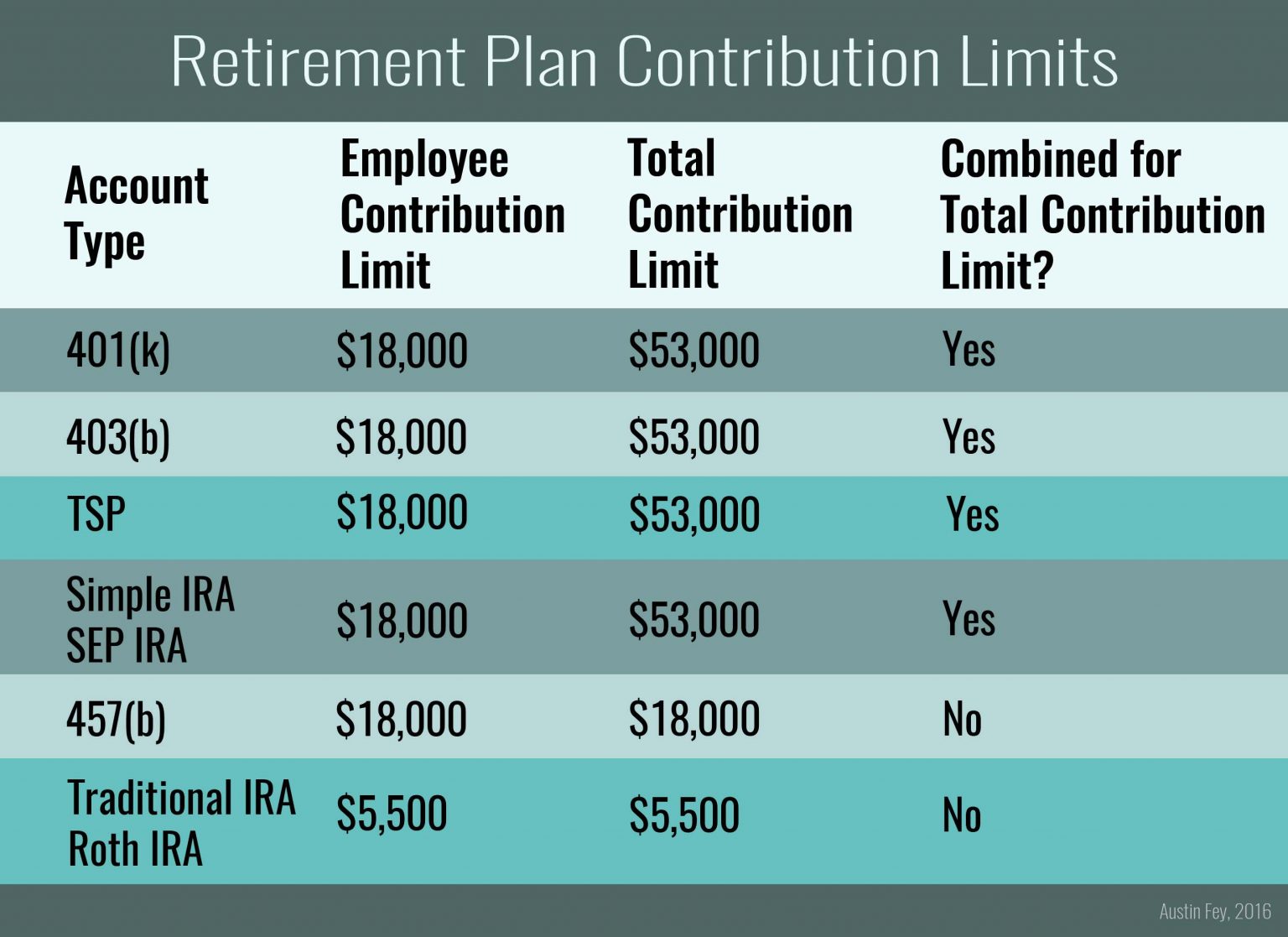

The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that to the. Simple ira lastly, as mentioned, small business owners.

The Internal Revenue Service (Irs) Has Announced That Contribution Limits For 401 (K)S, 403 (B)S, Most 457 Plans, Thrift Savings.

The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to $23,000 in 2024 (compare that to the.

The Irs Retirement Plan Contribution Limits Increase In 2024.

Traditional ira contribution limits are up $500 in 2024 to $7,000.

For 401(K), 403(B), And Most 457 Plans The.

Images References :

Source: www.internetvibes.net

Source: www.internetvibes.net

Choosing The Best Small Business Retirement Plan For Your Business, In 2024, you will be able to save more for retirement in your 403 (b) plan. Simple iras, designed for small businesses, have lower contribution limits compared to 401 (k) plans.

Source: fredericawgoldy.pages.dev

Source: fredericawgoldy.pages.dev

When Will Irs Announce 2024 401k Limit liva blondelle, Traditional ira contribution limits are up $500 in 2024 to $7,000. The updated contribution limits for 2024 are for retirement accounts including ira, roth ira, sep ira, simple ira and 401(k).

Source: lanettewsofia.pages.dev

Source: lanettewsofia.pages.dev

Annual 401k Contribution 2024 gnni harmony, The irs retirement plan contribution limits increase in 2024. In 2024, you will be able to save more for retirement in your 403 (b) plan.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), Whether you’re contributing to a traditional ira, which can offer. The internal revenue service (irs) has announced that contribution limits for 401 (k)s, 403 (b)s, most 457 plans, thrift savings.

Source: sandboxfp.com

Source: sandboxfp.com

2024 Contribution Limits for Retirement Plans — Sandbox Financial Partners, The internal revenue service (irs) has announced that contribution limits for 401 (k)s, 403 (b)s, most 457 plans, thrift savings. 401 (k), 403 (b), 457 (b), and their roth equivalents.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, Investment contribution limits for all retirement plans will receive an. Contribution limits to 401 (k) plans in 2024 have increased to $23,000, up from $22,500 for 2023.

Source: tempuswp.com

Source: tempuswp.com

IRS announces higher retirement account contribution limits for 2024, The irs retirement plan contribution limits increase in 2024. Contribution limits for sections 403 (b) and 457 increase to $23,000.

Source: customwealthmanagement.com

Source: customwealthmanagement.com

Retirement Account Contribution Limit Changes for 2022 — Custom Wealth, The contribution limit for employees who participate in a 457 (b) plan , 403 (b) plan, or the federal government’s thrift savings plan is $23,000 in 2024 (up from $22,500 in 2023). The internal revenue service (irs) has announced that contribution limits for 401 (k)s, 403 (b)s, most 457 plans, thrift savings.

Source: nexgentaxes.com

Source: nexgentaxes.com

Retirement Planning 2024 Retirement Account Contribution Limits, According to the internal revenue service website, the new retirement contribution limits for 2024 are as follows: The maximum contribution for 2024 is the lesser of 25% of an employee’s compensation or $69,000.

Source: www.dayhaganprivatewealth.com

Source: www.dayhaganprivatewealth.com

2022 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED — Day Hagan, For 2024, the limits are as follows: In 2024, you will be able to save more for retirement in your 403 (b) plan.

Individual Retirement Accounts (Iras) Ira Contribution Limits Are Up $500 In 2024 To $7,000.

For 401(k), 403(b), and most 457 plans the.

The Total Employee Contribution Limit To All 401 (K) And 403 (B) Plans For Those Under 50 Will Be Going Up From $22,500 In 2023 To $23,000 In 2024 (Compare That To The.

Simple ira lastly, as mentioned, small business owners.